Buying your first home is one of the biggest financial decisions you’ll make. Download our first-time homebuyer’s handbook to learn what’s involved.

Continue

Buying your first home is one of the biggest financial decisions you’ll make. Download our first-time homebuyer’s handbook to learn what’s involved.

Continue

Older adults are increasingly the targets of scammers who use deception and fear tactics to convince the elderly to send money or provide personal account information. Make sure your loved ones are aware of these common type of scams.

Continue

The average homebuying timeline will vary for everyone, but yours could potentially be delayed if you make a handful of certain financial moves. Learn what to avoid when buying a home.

Continue

If you’re known to dabble in a little online browsing, odds are you’ve encountered a pop-up once or twice. There are times when you may think, “Wow, that’s a great deal!” and click on a pop-up. If you ever see a pop-up, put down the mouse. Why? That pop-up could be malicious or dangerous. There…

Continue Don’t Trust Pop-ups

This America Saves Week, set some time aside to see if your savings plan is working for you.

Continue

Holidays are a busy and stressful time of year. There’s traveling and planning for visitors. Buying and wrapping presents for loved ones. Avoiding the flu. Cybercriminals know the hectic nature of holiday preparation and attempt to take advantage of anyone who may not be paying close attention, particularly older adults. It’s crucial that the elderly…

Continue Focus on Seniors: Watch Out for Holiday Scams This Season

October 18, 2019, is Get Smart About Credit day! The American Bankers Association Community Engagement Foundation works with banks around the country to raise awareness about the importance of using credit wisely. This national campaign aims to help young people develop responsible credit habits — from building a credit history to making responsible decisions regarding…

Continue It’s Time To Get Smart About Credit

Down payments are challenging for many first-time homebuyers. It seems that the initial financial stab at home ownership is among the greatest roadblocks of owning a home. If you are in the process of buying a home, using a gift can allow you to achieve that 20% down payment. This can help you get…

Continue Note the Rules of Using Gift Money for a Down Payment

There are some tips to keep in mind to begin the conversation about life insurance.

Continue

Flooding, hurricanes, fires or tornadoes. We know they can happen. If you haven’t witnessed it personally, just turn on TV or your computer to see the devastation in our region and elsewhere in the country. It’s hard to imagine the actual experience of having your home destroyed or living in temporary shelters. This inability to fathom the horrors of natural…

Continue Taking inventory of your homeowners insurance

It’s not all that uncommon. You tried to fix something in your house using all the analytic skills you apply to other parts of your life, inspired by how easy it looks on HGTV. With all the best of intentions, however, what seemed simple turned into an obviously less-than-expert job. In fact, even your Realtor…

Continue What Not To Do Yourself Before Selling Your House

The VA loan is one of the best mortgage loans there is. Here are some reasons why. First, VA guarantees the loan for 100% of the appraised value of the property (technically, the loan is for the Notice Of Value amount, which in most cases is the same thing). This guarantee means that the lender…

Continue Why Should I Use a VA Loan

Home appraisals are typically required during the home buying process in order to determine the current fair market value of the home. The home appraisal process is a combination of science and opinion—but mostly science, even though the value that the appraiser delivers is called an “opinion of value” as of the effective date of…

Continue How does a home appraisal really work?

A 20% down payment is anything but standard. Making a smaller down payment does involve some form of mortgage insurance (MI). Conventional loans are available with as little as 3% down.

Continue

Many first-time home buyers have stars in their eyes when they first begin house-hunting. Their ideal is a house that is move-in-ready, offers the number of bedrooms/baths/square footage they’re looking for, is in a great neighborhood and, of course, is within their budget. Matching all that criteria is often a tall order, especially the move-in-ready…

Continue First-time homebuyers reality check

Paying down your mortgage early may be possible, but is it smart?

Continue

A good summer trip takes careful planning and budgeting. Here’s a step-by-step guide for planning a fun but financially responsible summer vacation.

Continue

Here’s what citizens should know about keeping themselves, their loved ones and their homes and businesses safe from fires this year.

Continue

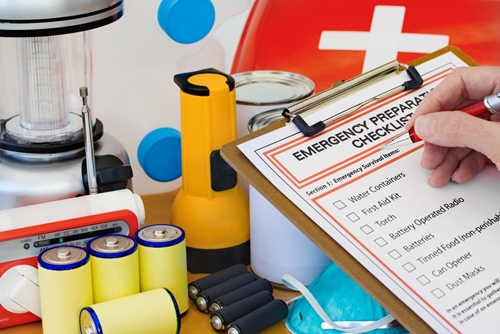

Take some time to determine which ways you’re prepared for a sudden disaster, and in what ways you’re not.

Continue

Bank Midwest debit cardholders enjoy the convenience and security of using a mobile wallet to pay for their purchases in person or online using Apple Pay, Google Pay or or Samsung Pay. Learn how to add your debit card to your mobile wallet!

Continue